The State of

Corporate Sustainability

Moving Beyond Energy Optimization

on the Journey to Net Zero

Welcome to the second annual State of Corporate Sustainability Report from Atrius®, part of Acuity Brands, and Smart Energy Decisions (SED)

Previously under the State of Energy Management name, this report marks the fifth collaboration between SED and Acuity Brands. Each year, this report serves as a reflection of the biggest trends, drivers, and challenges facing energy, facility, and sustainability teams.

This year's data regarding the current state of sustainability reporting and energy management reflects the experience and insight of 240+ industry professionals working at respected organizations in multiple sectors.

Corporate Sustainability Success Lies in People and Technology

This year the entire world witnessed a societal transformation driven by the rapid adoption of artificial intelligence and its integration into technology and tools in every sector. We've also seen regulation and sustainability mandates rise in importance, driven by a combination of stakeholders across every level of a business and community.

Data shows a significant gap between skilled sustainability professionals and the technology that accelerates progress - and it needs to be filled. We believe a combination of proficient people equipped with cutting-edge technology will lead us to a tipping point for success in corporate sustainability and drive our collective progress toward decarbonization and energy reduction goals.

Combining the scale and automation of technology with the passion and expertise of people is the biggest opportunity facing every corporate organization today.

Please scroll through the following for more of this year's major findings.

Progress towards Smarter, Greener Spaces & Scope 3 Emissions Tracking

As more organizations formally communicate sustainability goals every year, it’s important to benchmark our progress relative to our peers and collectively on this journey. Compared to last year’s results, this year saw a decrease in the number of respondents who state they’re ahead of pace on goals, while we saw an increase in the number of those who are behind.

Although it's not unusual for companies to declare net zero targets many years ahead, it is crucial for businesses to initiate actions and take steps today to achieve those goals successfully.

This year's survey again asked respondents to describe their progress in managing and reporting on sustainability initiatives, but also included an additional question specifically about their Scope 3 emissions.

Year-over-year Differences

In comparison to the previous year, we observe less organizations ahead of pace, with a decline from 12% to 6% in those who are ahead of pace. While our report doesn’t track a respondent's exact reasons, they could include:

- Limited awareness and understanding

- Resource constraints

- Prioritizing short-term goals

- Resistance to change

- Lack of standardization

- Uncertain returns of investment

- Complex supply chains

Sustainability Commitments at Various Stages of the Journey

To better understand sustainability progress, we first need to understand an organization's knowledge in their sustainability journey:

- Beginning: Organizations who are at the initial stages integrating sustainability goals and practices throughout the organization. They may be familiarizing themselves with sustainability frameworks, assessing the environmental impact of the organization, or identifying key areas for improvement.

- Middle: Organizations who have progressed beyond the foundational steps and are actively engaged and implementing strategies. They also may be collaborating with stakeholders to analyze and develop further initiatives.

- Advanced: Organizations who are seasoned with a comprehensive understanding of sustainability practices and have a track record of successfully measuring, managing, and optimizing data. They may be in the process or already automating their sustainability initiatives.

| Total | Advanced | Middle | Beginning | |

|---|---|---|---|---|

| Organization has Sustainability or Energy Reduction Goals (Net) | 94% | 100% | 100% | 91% |

| Resource reduction (including energy, water, waste) | 79% | 88% | 80% | 76% |

| Greenhouse gas (GHG) reduction | 76% | 98% | 88% | 76% |

| Sustainability / ESG Reporting | 60% | 81% | 76% | 50% |

| Carbon neutrality/Net Zero | 55% | 72% | 72% | 46% |

| Renewable energy target | 52% | 77% | 70% | 40% |

| Upgrading existing building automation or IoT infrastructure | 40% | 60% | 52% | 28% |

| None – Our organization hasn't set any goals | 6% | 0% | 0% | 9% |

Data Quality and Management

This year, we saw fewer organizations conducting real-time and automated utility data collection (31%) compared to 2022 (42%) and reverting to the levels seen in 2021 (33%). While there could be many reasons behind this trend, one hypothesis could be a lack of funding due to current economic conditions.

Question: How does your organization currently collect energy and sustainability data?

-

2023 Survey Data

-

2022 Survey Data

-

2021 Survey Data

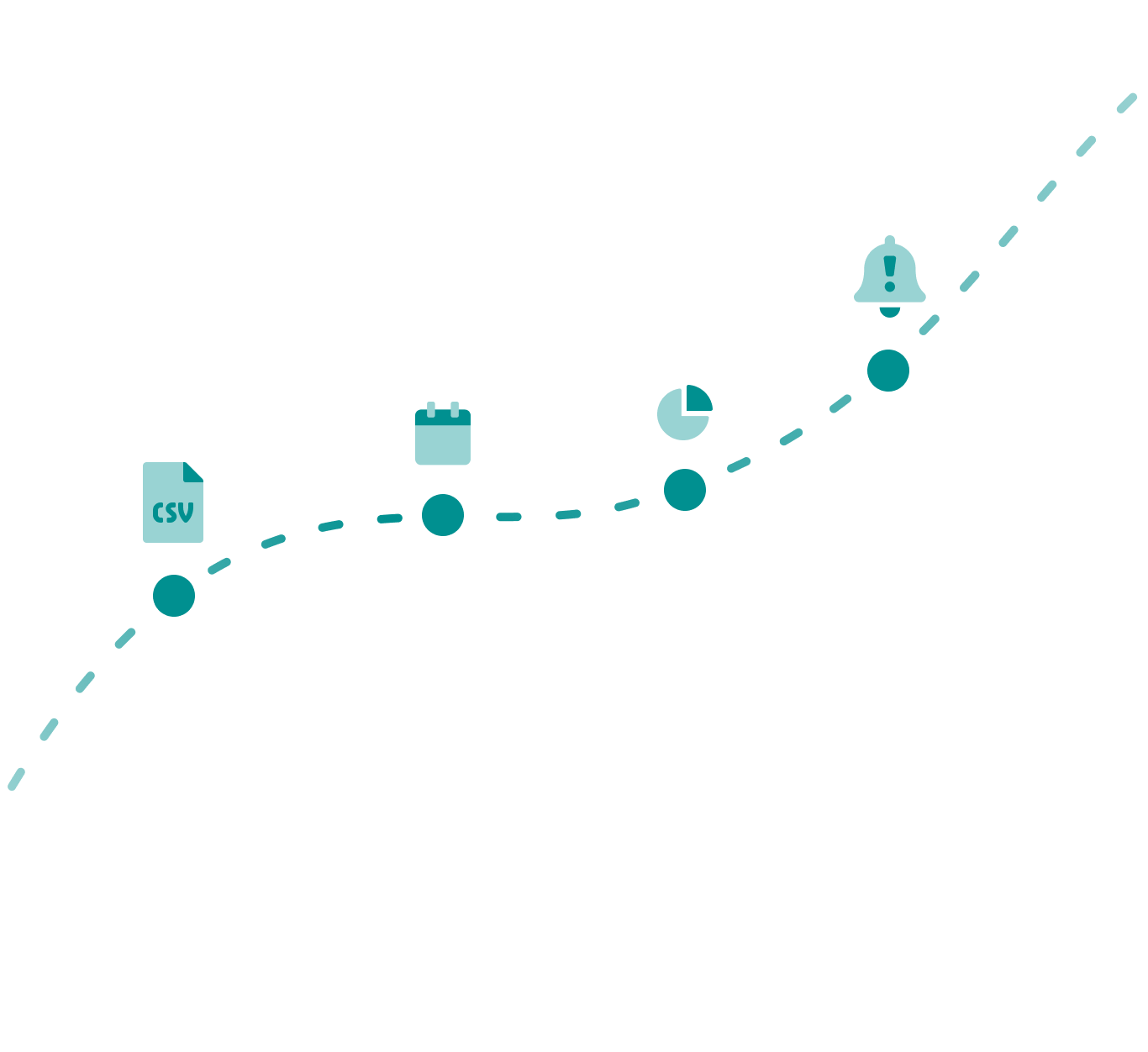

The Net Zero Journey Often Starts With Data Collection

This year’s results indicate organizations are at early stages when it comes to using energy and sustainability data to meet net zero targets; 30% are at the beginning (putting manual data in a spreadsheet) while 27% are taking their first steps (automated utility and emissions data into a centralized system).

Question: Which of the following best describes where your organization is on the journey in using energy and sustainability data to meet net zero targets?

Industry breakdown

Companies within the government (17%) and industrial (26%) verticals appear more likely to be at the beginning stages of putting data into spreadsheets. On the other side, higher education (24%) and commercial organizations (21%) are more in line with those in the supplier space at being advanced or well on their way.

Sustainability Reporting Standards

Accurate, comprehensive reporting is increasingly paramount as federal, state, and city regulatory reporting, financial disclosure requirements, and corporate ESG programs demand verifiable accountability. As important as these requirements are, including the adoption of Building Performance Standards (BPS), they are still labor-intensive processes that require large amounts of data and formatting.

This year’s results show an overall increase in the amount of organizations using a reporting framework to share progress.

Question: How does your organization report on year-end sustainability progress and goals?

Measurement and Verification on Capital Projects

This year, we saw fewer organizations conducting real-time and automated utility data collection (31%) compared to 2022 (42%) and reverting to the levels seen in 2021 (33%). While there could be many reasons behind this trend, one hypothesis could be a lack of funding due to current economic conditions.

Question: How do you perform Measurement & Verification on existing projects?

Creating a Culture of Sustainability

A central part of every corporate sustainability strategy is the ability to communicate progress both internally and externally. With this question, we wanted to understand which methods organizations were prioritizing in keeping various stakeholders informed of progress toward goals. Overall, company websites continue to be the most common communication method used.

Question: How does your organization communicate sustainability goals to associates and stakeholders?

Results show that organizations appear to be consciously focused on creating a sustainability mindset across their business more than the previous year. Compared to last year’s results, we saw an increase in every major category of how organizations are integrating sustainability into their business strategy, citing the increased importance in communicating goals in all channels surveyed.

Question: How are ESG goals integrated into your organization's business strategy?

Roles and Responsibilities Across Departments

We also asked respondents which departments played a role in their sustainability efforts. Across the board, most major departments were listed at or above 25% with a key highlight of suppliers indicating that companies are focusing on ensuring that the third-party organizations they partnered with complement their efforts.

Question: What departments play an active role in sustainability efforts?

Top Goals for Corporate Sustainability Programs

When looking at this data based on job function, energy, sustainability, and c-suite respondents all placed access to data as their top priority.

We see automating emissions reporting increasing by 19% from the previous year as organizations increasingly turn to automation to enhance the accuracy and efficiency of their emissions reporting processes. Leveraging advanced technologies like artificial intelligence and data analytics allows organizations to streamline the collection, analysis, and reporting.

Question: Please rate how important each of the following tactics is for the success of your overall sustainability strategy. (Rate on a scale of 1-5 scale where 1=not at all important through 5=extremely important) available)

Corporate Sustainability Budget & Resources

Every year, one of the biggest challenges sustainability professionals face is the lack of resources for their programs. We wanted to better understand what current investments were made to sustainability programs in an effort to increase transparency on what resources look like across all levels of the journey.

Question: How much budget do you have to spend on resources to support your carbon accounting and sustainability reporting?

Desire for Increased Budgets

Seventeen percent of companies are not budgeting for resources to support this venture and this is consistent across all business types. More than half (54%) of those advanced on their journey to net zero targets are spending $250K+. Respondents also expressed a heightened need for increased budgets, citing that many do not have enough budget or feel financially equipped to achieve their goals year-over-year.

Question: In your opinion, based on the sustainability goals set by your organization, do you have the budget needed to achieve these goals?

Responses by job function:

| Facilities | Energy | Sustainability | C-Suite | |

|---|---|---|---|---|

| Yes | 37% | 43% | 34% | 57% |

| No | 63% | 57% | 66% | 43% |

Two Biggest Barriers to Success: Data Quality and Labor Shortages

Excluding possible budget constraints (asked separately), data quality problems (47%) and labor/manpower (45%) are the top two barriers to implementing your sustainability strategy. Lack of labor is a much bigger barrier for non-supplier organizations with higher education at 55%, industrial at 46% and commercial at 45%. Lack of support from internal departments or the C-Suite is also a barrier affecting direct organizations more than suppliers.

Question: Aside from possible funding budget constraints, which of the following are barriers to successfully implementing your sustainability strategy?

Key Factors for Sustainability Success

As we delve into the crucial elements that bolster sustainability programs, we see consistency from year over year. A slight rise in respondents who listed "resources and funding" from 75% to 80% between 2022 and 2023 indicates this is still a top priority for sustainability professionals. This elevation signifies a growing consensus on the essential role of financial support in achieving sustainable milestones.

Utility incentives and centralizing data streams, although slightly fluctuating, each maintain a steady recognition. Automating emissions saw the largest year-over-year increase, rising by 13% from the previous year as organizations increasingly turn to automation to enhance the accuracy and efficiency of their business processes in every department. Leveraging advanced technologies like artificial intelligence and data analytics allows organizations to streamline the collection, analysis, and reporting.

Question: Which of the following factors are important to the success of your sustainability program?

Survey Methodology

Smart Energy Decisions deployed an online 19-question survey on behalf of Atrius to energy, facility, and sustainability leaders in various organizations across seven industries. The survey was completed by 247 respondents in September and October 2023.

You made it all this way, why not get to know us a little bit?

Atrius delviers edge-to-cloud solutions enabling buildings to become smarter, safer, and greener. Check out some highlights from our resources section to learn more about what we do: