California has been a leader of green policy for years. Its recently passed climate-related disclosures laws are expected to help further its ambition. In 2006, California passed its first GHG emissions goal known as the Global Warming Solutions Act” to achieve 1990 emissions levels by 2020, which it achieved in 2016, four years ahead of schedule.

In 2017, it increased its goals under a scoping plan to achieve a 40 percent reduction below 1990 levels by 2030 towards carbon neutrality by 2045. To get there, it has passed numerous laws addressing technology and energy shifts, pollution, jobs, and climate finance:

- Zero-emission vehicles (ZEVs) for 100 percent of new car sales by 2035

- Cut air pollution by 71% and emissions by 85% by 2045

- Achieve 100% clean energy by 2045

- Create 4 million new jobs

- Invest $54 billion to meet climate targets

On October 7, 2023, California’s Gov. Gavin Newsom signed two new climate-related disclosures into law, affecting businesses:

- Climate Corporate Data Accountability Act (SB 253) – for reporting Scope 1, 2, and 3 GHG emissions, and

- Climate-Related Financial Risk Act (SB 261) – for reporting climate-related financial risks and opportunities, and a business strategy to address them.

The two laws require an estimated 5,400 businesses to report under the Climate Corporate Data Accountability Act and 10,000 under the Climate-Related Financial Risk Act, affecting both publicly listed and privately held organizations.

California has the largest state-level economy in the US and the largest sub-national economy in the world, making these rules impactful on a national and global scale. The added disclosures will make corporate climate information more transparent in the state.

California’s adoption of these laws not only precedes the SEC’s pending approval of its proposed Climate Disclosure Rule, but they also have stronger requirements and apply to a wider range of businesses.

Climate Corporate Data Accountability Act (SB 253)

- Who needs to report: Public or private companies “doing business” in California with over $1 billion in annual revenue, based on revenues from the previous fiscal year. This law affects approximately 5,400 companies.

- What do companies need to report: In 2026, companies need to start reporting their Scope 1 “operational” and Scope 2 “purchased energy” emissions annually. In 2027, companies need to begin reporting their annual Scope 3 indirect “value chain” emissions. Organizations should follow the GHG Protocol for guidance on establishing reporting boundaries, measuring baseline emissions, and reporting emissions in subsequent years.

- Assurance: The information reported will be subject to limited third-party assurance in the initial years of reporting, and this requirement is scheduled to increase to reasonable assurance in later years.

- Avoiding repetition: Organizations can submit reported information that is formatted in alignment with other standards or laws as long as the organization provides all of the information requested by California.

- Fees and Penalties: Reporting organizations will be subject to an annual reporting fee covering the implementation of the act. The California Air Resources Board (CARB) has the authority to penalize companies that don’t file at all, file late, or file incompletely per the disclosure guidelines for Scope 1 and 2 emissions and with fees of no more than $500,000. For Scope 3 emissions, the state board will only issue penalties for the failure to file until 2030.

Climate-Related Financial Risk Act (SB 261)

- Who needs to report: Public or private companies “doing business” in California with over $500 million in annual revenue, based on revenues from the previous fiscal year. This law affects approximately 5,400 companies. Insurance businesses are excluded from this requirement.

- What do companies need to report: In 2026, companies need to start reporting their climate risk disclosures biennially.

The reports should contain information recommended by the Task Force on Climate-related Financial Disclosures (TCFD), including governance, strategy, risk management, and metrics and targets.

Organizations will also be requested to report their activities to mitigate (reduce emissions) and adapt (improve resilience) to climate-related risks.

- How to report: Companies must report their climate risk disclosures publicly on their websites. Companies are allowed to consolidate reports under the parent company.

- Disclose or explain rule: Organizations are required to explain any gaps in their reported information with their plans to improve reporting in subsequent reporting periods.

- Penalties and fees: As with SB 253, the California Air Resources Board (CARB) has the authority to collect filing fees and issue penalties for violating the reporting requirements if the company shows a failure to report in good faith. Fees for SB 261 shall not exceed $50,000 in a reporting year.

Definition of “doing business” in California

This includes businesses pursuing financial activity in California, which are domiciled in California or that show sales, property, or payroll exceeding certain amounts, per existing California law.

Alignment with other regulations

California’s laws coincide with a larger trend towards enhanced climate reporting across major global economies such as the EU, where the CSRD has gone into effect. CSRD affects large multinational corporations with EU subsidiaries as well as local businesses.

In the US, the SEC could soon finalize its climate disclosure rule, affecting publicly listed companies operating in all states. However, California’s rules are stronger than those proposed by the SEC, aligning more closely with Europe’s approach to climate disclosures.

This makes it the most stringent reporting regulation of its kind in the US. However, the EU’s CSRD contains disclosure requirements on a wider range of environmental, social, and governance topics.

| US SEC Climate Disclosure Rule | California SB 253 | California SB 261 | EU CSRD | |

| Scope 1 and 2 emissions | Yes | Yes | NA | Yes |

| Scope 3 emissions | No | Yes, if material or a Scope 3 goal or target applies | NA | Yes |

| TCFD-aligned climate risk reporting | Partially | NA | Yes | Yes |

| Limited to reasonable assurance required | Yes | Yes | NA | Yes |

| Level of financial activity in region | Companies listed in a US stock exchange. | Entities with over $1 billion in revenue doing business in California | Entities with over $500 million in revenue that do business in California | EU-based companies or subsidiaries |

| Includes Privately held companies | No | Yes | Yes | Yes, for companies of a certain size |

| Timeline | 2026 | 2026 – Scope 1 and 2 2027 – Scope 3 emissions, if material | 2026 | 2025 – Companies already reporting under NFRD2026 – Companies that pass 2/3 of the business size thresholds in CSRD2027 – Simplified rules for listed SMEs 2028 – Certain non-EU companies |

| Sustainability topics addressed | Climate risk and GHG emissions | Climate risk and GHG emissions | A total of 12 environmental, social, and governance topics. |

GHG emissions reporting is becoming mainstream

Many organizations have been reporting and monitoring their GHG emissions and climate risks for years, with commitments to implement more sustainable practices for a better future. Yet, the added level of assurance and inclusion of privately held companies raises the bar in California.

While the rules only impact organizations of a certain size, Scope 3 emissions reporting means the ripple effect could be felt across these companies’ entire value chains, affecting more than just the highest-earning businesses. Organizations of all sizes could face new requests to measure, track, and report their emissions.

Organizations that lack a GHG emissions management approach should start preparing now to update their business practices. This will help them meet investor and purchaser requests with strong, well-organized data and internal processes.

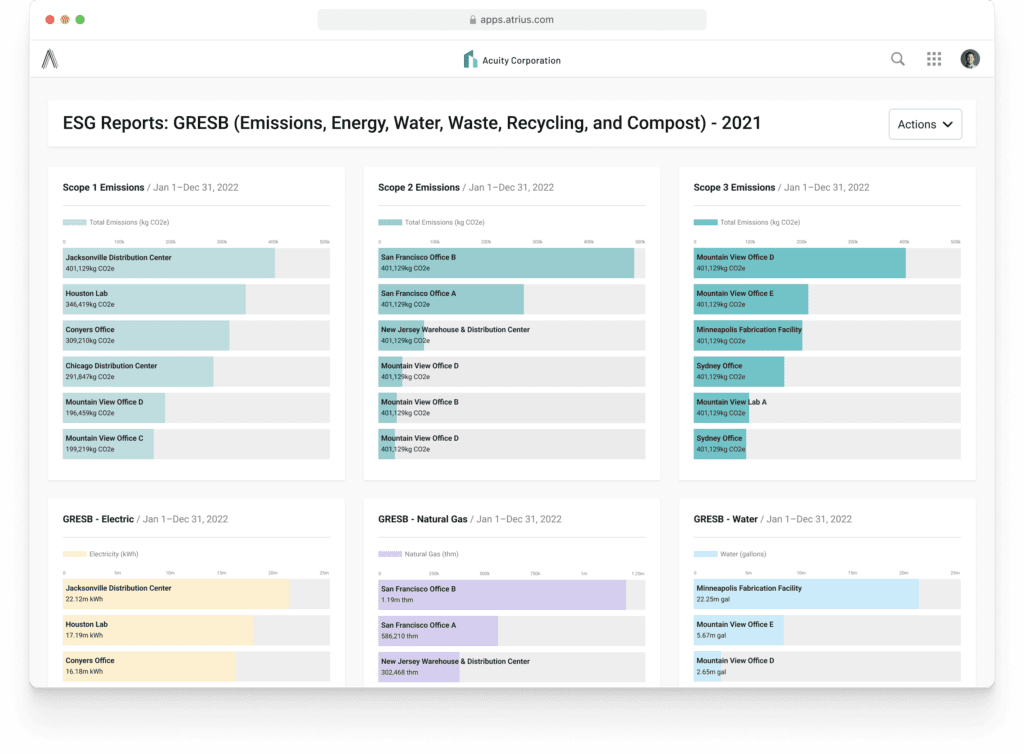

Atrius Sustainability helps organizations of all sizes manage their GHG emissions with our useful features:

- Aligned to GHG Protocol

- Use data outputs given in easy-to-report formats

- Automate data imports

- Assign emission factors to activities

- Consolidated resource use and activity data

- Customize reporting boundaries for different business models

- Communicate performance and trends with dynamic dashboards

Busy organizations can save time and simplify GHG emissions reporting with Atrius. Learn more.