The EU’s Corporate Sustainability Reporting Directive (CSRD) requirements are significantly increasing in 2024. A total of 49,000 businesses and subsidiaries based in Europe must adhere to Europe’s new set of environmental, social, and governance reporting standards in 2024.

These standards synthesize elements of other voluntary reporting frameworks and standards such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) standards. However, they also advance key concepts such as “double materiality,” which no other set of standards applies. Moreover, no other region has mandated standards that cover the same breadth of ESG dimensions in one set of standards. Issues like biodiversity and Scope 3 emissions have yet to achieve mandatory reporting status anywhere else. For these reasons, Europe’s new standards are unique and progressive in both their breadth and scope.

By 2021, just 29 countries had some form of ESG reporting standards. Most of these address a single issue, such as climate change. For instance, the U.K. requires certain businesses to disclose their climate risks and carbon emissions using standards modeled after the TCFD framework. In contrast, the EU is pursuing a more holistic approach with its EU Green Deal by addressing both the social and environmental ramifications of climate change.

The EU’s updated CSRD reporting requirements simultaneously support the region’s Paris Agreement target of achieving reducing net greenhouse gas emissions by at least 55% by 2030 from 1990 levels and the 17 United Nation Sustainable Development Goals, which touch on issues of human rights, social inequalities, and poverty reduction. The reporting requirements are just one part of a larger sustainable finance roadmap aimed at transitioning the EU’s economy to remain resilient for future generations.

Overall, the CSRD presents a significant management challenge for organizations to overcome. Embedding technology-enhanced sustainability management approaches is going to be essential for companies operating in Europe. At the same time, the changes represent an opportunity for sustainability leaders to access more investment and win the favor of customers prioritizing sustainability. The approach to sustainable finance could also have a ripple effect across other regions, making an organization’s sustainability credentials more valuable than ever before. Here’s what you should know about CSRD.

What is the CSRD?

The CSRD outlines key measures to update Europe’s ESG Reporting requirements for businesses. It is designed to enable key stakeholders to effectively assess companies’ sustainability performance.

CSRD aligns with Europe’s goals to achieve Net Zero by 2050, which are advanced by a number of recent policies and frameworks, such as the European Green Deal, the EU Taxonomy, and others. It also addresses shortcomings of the previously adopted Non-Financial Reporting Directive (NFRD), such as vague requirements, inconsistent and incomparable data, and low compliance rates.

The CSRD entered into force on January 5, 2023, and companies will need to report for the first time in alignment with CSRD in 2025 for data collected over the 2024 reporting period. It determines who must report, how they should format their reports, and what standards they should follow; namely, the European Sustainability Reporting Standards (ESRS), adopted on July 31, 2023.

Who needs to report in line with CSRD?

The number of companies required to report their ESG information in Europe is increasing from about 11,000 to 49,000 companies, including:

- All publicly-listed companies

- Companies that meet two of three of the following criteria:

- Companies with over 250 employees

- Companies with EUR 40 million+ in turnover

- Companies with EUR 20 million+ in total assets

- Subsidiaries of parent companies not based in the EU that meet the above-listed criteria are also required to report.

The earlier NFRD applied only to large public interest entities with over 500 employees, so the change brought by CSRD will be significant.

When does CSRD go into effect?

CSRD states that reporting companies should collect data and insights for the 2024 reporting period. Their first CSRD-aligned reports for the 2024 period should be submitted in 2025.

What makes CSRD different?

Many features of CSRD make it more advanced than any other ESG reporting regulation in the world. Here are some of the most significant changes it represents.

Mandatory reporting: CSRD is the first mandate in the world to require companies to report not only on their Environmental performance, but also their Social and Governance performance. This marks an important shift for ESG reporting, which has previously been a predominantly voluntary practice.

Double materiality: Organizations are asked to assess the materiality of ESG issues based on “double materiality.” This perspective incorporates two main approaches to ESG materiality: one considers the financial risks from ESG impacts on companies, while the other considers the companies’ own impacts on ESG aspects impacting their diverse stakeholders. Double materiality emphasizes both financial- and impact-oriented materiality, satisfying the needs of investors and broader stakeholders alike.

Scope 3 emissions reporting requirement: CSRD will eventually require all organizations to report their Scope 3 emissions, which often represent the majority of an organization’s overall emissions. Scope 3 emissions are defined by the GHG Protocol as the emissions from upstream and downstream activities of an organization’s operations.

So far, most of the mandatory non-financial reporting requirements around the world align with the Task Force on Climate-related Financial Disclosures (TCFD). However, TCFD recommends, but does not require reporting Scope 3 emissions unless they are material to the organization’s ESG strategy. Therefore, CSRD enhances the breadth of emissions organizations are expected to report on.

Forward-looking strategy: With its alignment to TCFD, CSRD has adopted a forward-looking approach, because organizations’ actions today can significantly worsen the impacts of climate change in the future. To address the accelerating rate of climate impacts, which increase in frequency and intensity over time, TCFD requires businesses to submit a forward-looking strategy, targets, risk management approach, and risk assessments. CSRD not only adopts this approach in its climate-related disclosure requirements, it also applies it to all of the ESG topics included in its reporting standards.

Third-party assurance requirement: CSRD requires reporting entities to independently verify their ESG reports using limited assurance by certified auditors. After a few years, the level of assurance will increase to a reasonable assurance standard. This requirement is designed to improve the quality of reported data to a decision-useful standard.

Reporting format requirements: Reporting companies are required to report their CSRD-aligned information in a dedicated section of their Management Report.

The CSRD reporting period should align with their fiscal year and annual report submissions. The report should be formatted in an electronic format using XHTML digital tagging. Reporting companies will be required to upload their reports to the European Single Access Point (ESAP).

Sections covered by ESRS:

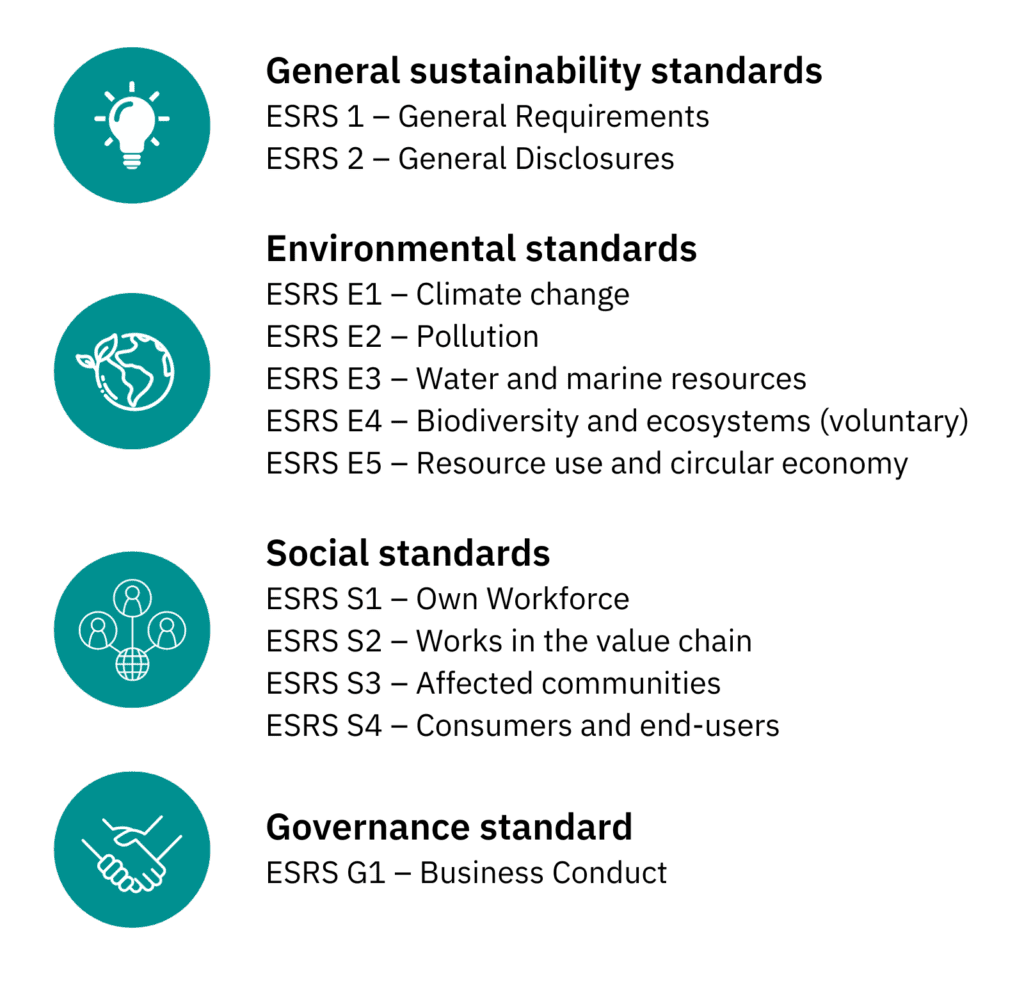

The ESRS requires organizations to report on the following topics:

CSRD reporting is easier with Atrius

Atrius is an environmental reporting platform designed to meet a wide range of reporting needs, including companies reporting in alignment with CSRD. The table below outlines the key ways Atrius can serve as a cost-effective and time-saving partner in your CSRD reporting journey.

| CSRD Environmental Reporting Requirements | Our Atrius Solution |

| Disclose Environmental Data in the following categories: Climate Change Pollution Water and Marine Resources Biodiversity and Ecosystems (currently voluntary) Resource Use and Circular Economy | The Atrius platform is fully aligned with the GHG Protocol’s reporting guidelines for Scope 1, 2, and 3 emissions. Emissions data can be tagged and organized by type, source and carbon emissions factors, offering the largest available range of these factors available. Our platform offers flexible management approaches with the option to use templates or custom data organization and measurement approaches. The methodologies are clearly communicated in the data outputs, in alignment with the reporting requirements of most ESG standards and frameworks. Emissions data can easily be organized by grouping data and categorizing the data by type, and emissions scope. Our platform supports all 15 scope 3 emissions categories and enables estimations for hard-to-access scope 3 emissions source data using verifiable methods. Multiple users can also access the platform, in case suppliers or other external users will need to input scope 3 emissions data. We collect emissions data from global sources including the EU. Our metrics and currencies support those used in the EU. |

| Disclose Scope 1, 2 and 3 emissions in alignment with the GHG Protocol | Our CSRD Template supports reporting for CSRD-specific needs. Users can start with this template to adhere to the reporting requirements set by CSRD for their environmental data. Not limited to CSRD reporting, our global geographic scope and customizable organizational structuring system enables users to modify the platform to suit the reporting requirements across different regions. Whether you need to consolidate data into a central structure or sub-divide reporting approaches for different regions, our tool is perfect for generating custom-reported outputs. It accommodates all business structures and sizes from the building to the company levels. Users can group different buildings or data points in any way needed to adapt to different reporting needs. |

| Disclose business strategy for all ESG topics, including Targets and Risk Mitigation | Key features of our Atrius platform support the development of strategy over time. Our platform contains baseline algorithms to set baselines based on the data in the platform, and our reports enable tracking these baselines against your actual data. Our dashboard graphics and visualizations in the platform support forward-looking planning by pulling the data into one place and depicting year-over-year trends. This enables organizations to more effectively and efficiently analyze the data, establish priorities and set goals. In the software solution, users can plan and create different projects to achieve their targets. They can also flexibly and creatively develop strategies for improvement using our solutions simulations, track and monitor project data, and verify these projects against their baselines. Our platform also supports forward-looking planning by enabling users to investigate project costs and test projects before implementing them at a larger scale. Users can also incorporate carbon emissions factors and regional utility rates to assess the carbon emission impacts of their plans and strategies. |

| Report the activities of businesses headquartered or with subsidiaries in Europe | Our platform is independently audited and verified by Apex, a leading third-party environmental assurance organization. All of our outputs are designed to be audit-ready, so you can streamline the assurance process and provide your third-party auditor with the exact information they need in an organized format. |

| Verify your reported data with third-party limited assurance | Our platform is independently audited and verified by Apex, a leading third-party environmental assurance organization. All of our outputs are designed to be audit-ready, so you can streamline the assurance process and provide your third-party auditor the exact information they need in an organized format. |

Why choose Atrius?

Did you know Atrius is an award-winning environmental tech platform? Our data-driven solutions to managing environmental performance have achieved numerous accolades.

- Environment + Energy Leader named Atrius a 2023 Top Product of the Year for our building emissions reduction and data tracking, thanks to our “proven results.”

- Business Intelligence Group named Atrius a 2023 Sustainability Leader Award for our overall commitment to sustainability.

- Juniper Research awarded Atrius with a Platinum Award for Carbon Emissions Reduction in its 2023 Future Digital Awards for Smart Cities & IoT Innovation.

- ESG Investing recognized Atrius as runner-up for its Best ESG Data Science Software and its Best Specialist ESG Data Provider awards.

By embedding ESG expertise into our platform, we ensure you save time. We drive teams towards their goals faster by decreasing the GHG emissions learning curve needed to make an impact.

Demo our platform to see our features in action.