Organizations are facing stronger expectations to level up their environmental, social, and governance (ESG) reports with higher-quality environmental data. No longer just a requirement for Fortune 500 companies, small- to medium-sized enterprises (SMEs) have also begun producing non-financial sustainability reports and tracking and monitoring their environmental impacts. This has brought an unfamiliar set of challenges to many organizations from upskilling their teams to gain carbon accounting expertise to tracking and monitoring environmental impacts across their organization and value chain.

The most commonly reported environmental impact data includes:

- Water consumption

- Waste, recycling and compost

- Energy consumption

- Greenhouse gas (GHG) emissions

GHG emissions data often presents the heaviest lift to collect, track, and monitor. Growing these capabilities is important, though, because this data is increasingly valuable for investors, regulators, and consumers. They use it to:

- Verify organizations’ progress toward their Net Zero commitments

- Identify low-risk investments or more environmentally-friendly products

- Strategically reduce emissions through decarbonization efforts

To report GHG emissions accurately and effectively, it is important to compare carbon accounting recommendations across different environmental, social, and governance (ESG) frameworks and standards. Accurately reporting carbon emissions under these different standards requires an effective carbon accounting software like Atrius.

ESG Reporting Frameworks and Standards

With over 600 reporting frameworks and standards available for organizations to choose from when reporting ESG activities, starting the reporting journey can be daunting.

Here are the most common ESG reporting frameworks and standards used for reporting carbon emissions and other details linked to non-financial activities and performance.

Task Force on Climate-related Financial Disclosures (TCFD)

The Financial Stability Board (FSB) first released its TCFD recommendations in 2017, following mounting concerns about the likelihood that climate risks could destabilize the global economy. At first a voluntary standard, many jurisdictions around the world now require at least larger organizations and/or financial institutions to report in alignment with the TCFD recommendations including the EU, UK, Canada, New Zealand, Singapore, and others.

Key facts:

- Sectors: TCFD is used by all sectors and industries.

- Primary audience: Financial regulators.

- Structure: Organizations report on their Governance, Strategy, Risk Management, and Metrics and Targets.

- Carbon emissions reporting: TCFD recommends reporting Scope 1 and 2 emissions and Scope 3 emissions when they’re significant: ~40% or more of an organization’s overall emissions.

- Reporting deadline: No set deadline.

Global Reporting Initiative (GRI)

The GRI formed in 1997 and grew to become one of the most widely used sets of standards for reporting to multi-stakeholder audiences. Led by the Global Sustainability Standards Board (GSSB), GRI released its first comprehensive global sustainability standards in 2016, providing requirements for organizations to report on their impacts on the environment, economy and people.

Key facts:

- Sectors: GRI is used by all sectors and industries. GRI has released 3 of 40 sector standards which it is currently developing.

- Primary audience: Multiple stakeholders.

- Structure: GRI’s Universal Standards include GRI 1, 2, and 3, which cover the foundational guidelines and principles of reporting, general disclosures, and material topics disclosures, respectively. Disclosing under the GRI Sector Standards (labeled with two-digit numbers) and GRI Topic Standards (labeled with three-digit numbers) is optional.

- Emissions reporting: Emissions disclosures are specified under topic standard GRI 305 2016, which includes Scope 1, 2 and 3 CO2 emissions in metric tons (absolute emissions), carbon emissions intensity, and additional greenhouse gasses in kilograms or multiples.

- Reporting deadline: No set deadline.

Sustainability Accounting Standards Board (SASB)

SASB is a non-profit organization founded in 2011, which created a set of standards useful for the investment community to assess organizations based on discrete disclosure topics and associated metrics across a wide range of industry sectors.

- Sectors: 77 industry sector standards available.

- Primary audience: Investors.

- Structure: Disclosures fall under five categories: the environment, human capital, social capital, business model and innovation, and leadership and governance. Disclosure topics contain standardized quantitative or qualitative metrics to report. There are an average of 13 metrics per industry.

- Emissions reporting: Research the SASB disclosures for the relevant industry sector for more details.

- Reporting deadline: No set deadline.

CDP (formerly the Carbon Disclosure Project)

CDP is the largest global database of voluntarily reported environmental data. Founded in 2000, CDP administers a questionnaire on climate impact, which CDP members fill out annually. CDP added a water security questionnaire in 2010 and launched a new forest questionnaire in 2017. Reporting organizations are scored based on their responses to the questionnaire in CDP’s annual “A-List” report.

- Sectors: Organizations responding to the questionnaires are prompted to choose up to three primary sectors from among a list of 17 sectors or select “all other sectors” if none apply.

- Primary Audience: Multiple stakeholders.

- Structure: CDP offers three main questionnaires: climate change, forests, and water security. The climate change questionnaire aligns with TCFD and also includes questions on emissions details (see below), carbon pricing, engagement, and biodiversity.

- Emissions reporting: Aligned with TCFD, CDP recommends reporting Scope 1 and 2 emissions, and where relevant, Scope 3 emissions. Organizations also report their emissions methodology, data, and breakdown as well as energy, additional metrics, and verification.

- Reporting deadline: End of July: the exact date varies each year.

Global Real Estate Sustainability Benchmark (GRESB)

Founded in 2009, GRESB is a commercial real estate benchmarking organization that collects self-reported data to produce assessments in four commercial real estate benchmarks: real estate, real estate development, infrastructure fund, and infrastructure asset. GRESB is aligned with the Sustainable Development Goals, the 2015 Paris Agreement, and major ESG frameworks including GRI, SASB, and CDP. Reporting entities are scored with a percentage (maximum 100) according to region, sector, and property type to aid quick, reliable comparisons.

- Sectors: Commercial real estate and infrastructure.

- Primary Audience: Investors.

- Structure: GRESB contains four main sections: sustainability governance, implementation, operational performance and stakeholder engagement.

- Emissions reporting: GRESB has a distinct GHG estimation model for built assets by type that requires calculation of missing data estimation, absolute emissions, and emissions intensity.

- Reporting deadline: July 1.

In addition to these ESG frameworks and standards, a few recent updates are worth noting.

ISSB – The International Sustainability Standards Board (ISSB) and the International Financial Reporting Standards (IFRS) Foundation have been working to streamline many of the most widely used ESG standards and frameworks into a single set of global standards. On June 26, they released their inaugural standards on sustainability risks and opportunities (S1) and climate disclosures (S2). The IFRS is now responsible for monitoring both SASB and TCFD disclosures.

CSRD (EU) – Europe has been at the forefront of creating a sustainable finance ecosystem. In 2024, it will require a total of 50,000 companies active in the EU to report their Scope 1, 2 and 3 emissions and verify their reports with external assurance in alignment with its European Sustainability Reporting Standards (ESRS), mandated in its Corporate Sustainability Reporting Directive (CSRD). The EU Commission is creating revised limited standards to apply to non-listed and listed SMEs, to adjust the standards to be proportionate to the size of an organization.

Managing the emissions reporting process

It can be a challenge to strategically develop the organizational capabilities for reporting in alignment with these frameworks and standards. Lacking the right tools, we’ve seen organizations collecting GHG emissions data on “bespoke” spreadsheets. Strapped for time, organizations also add the responsibilities to positions who aren’t familiar with emissions types, sources, or factors, such as office managers or energy engineers. This presents a data management challenge and a high learning curve for the individuals to undertake.

When organizations do have a dedicated sustainability officer or program lead, they often find themselves burdened by the administrative workload. They must balance rigorous data collection and management with implementing programs and initiatives to meet their sustainability goals. The hefty administrative workload delays their progress, while hiring external consultants to assist them can be expensive.

To move past the administrative hurdle of carbon accounting, organizations need an effective tool. This is where Atrius comes in.

Carbon accounting made easy

Organizations don’t need to become carbon emissions experts just to measure and report their emissions. An effective tool can bridge the knowledge and skills gap.

The Atrius platform is built on a robust foundation of industry-standard methodologies, 1,500 carbon emissions sources, and 85,000 carbon emissions factors. It contains all of the technical details needed to report so users can effectively report even if they only have a general understanding of the data.

Once you input your emissions data into the software, the platform seamlessly produces carbon emissions outputs. These outputs align with the unique requirements for a wide range of sustainability standards and frameworks.

With Atrius, there is less room for error in your carbon accounting and management, given its pre-built and rigorously tested system. Your carbon data will be housed in one central platform, which you can use to draw year-over-year comparisons, visualize the data to present it to key stakeholders, and use to identify strategies for carbon emissions reductions.

The data outputs are also ready for external assurance. In fact, the methodologies embedded in the platform have themselves been externally assured by the leading ESG consultancy, Apex companies.

As a user-friendly tool, Atrius saves time. The software can reduce the time needed for carbon management equivalent to the time of two full-time positions. Granted, there is still set-up time required for collecting data from sources, but in following years, sustainability teams can devote their time to driving impact faster.

Taking the next step

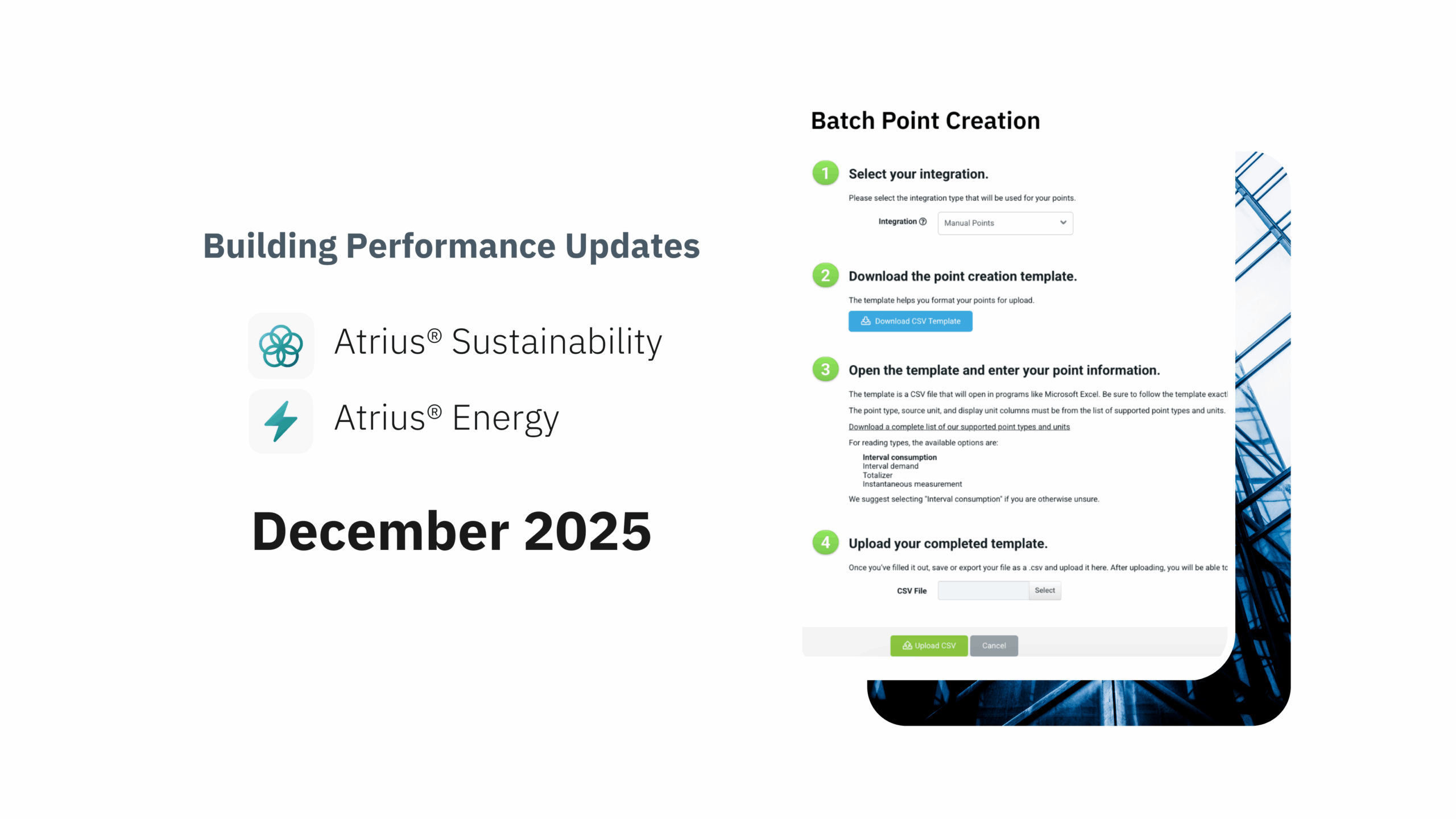

If you’re ready to start, here are some essential steps to implementing our carbon accounting platform:

- Create your team: Choose one or more sustainability professionals assigned to acquire the data to input into Atrius.

- Make a plan: Identify how and when you’ll collect your data and its sources. This could require input from multiple departments in your organization.

- Collect and input the data: Follow the guidelines within the software for collecting your carbon emissions data. Input the data in the appropriate fields, using our set-up guide.

- Report and communicate: Use Atrius outputs to report your carbon emissions in different ESG standards and frameworks. Communicate your impacts and key improvements with data visualization to your senior executives and key stakeholders.

Embark on your ESG reporting journey with Atrius. Schedule a demo today.