This article was originally published on Facility Executive.

As companies continue to build and act upon their sustainability practices and commitments, they will soon be faced with new regulatory challenges. This spring, the U.S. Securities and Exchange Commission (SEC) announced enhanced disclosure requirements for advisers and funds that claim to have a focus on Environmental, Social, and Governance (ESG) factors. Beginning in 2023, publicly traded companies will need to track and report all carbon emissions generated by their value chain.

These new requirements will make an impact in the fight against climate change—namely, they will help reduce the issue of greenwashing, the practice of making false statements about a company’s commitment to ESG standards. Full transparency about corporations’ carbon footprint throughout their operations will hold all companies to a higher standard, as those who don’t stand by their commitments can face public scrutiny. By following these new regulations, sustainably focused companies will better understand how to make drastic improvements in reducing their environmental footprint.

While calculating an organization’s entire value chain may appear to be a daunting task at first glance, with a full understanding of the new requirements and how to capture the required data, companies will be able to quickly adjust to these new standards and do substantially more in their sustainability journey.

WHAT ARE THE NEW SEC RULES COMING IN 2023?

Many companies have already been tracking and reporting Scope 1 and Scope 2 emissions. Scope 1 or “direct” carbon emissions are created by assets a company owns, such as buildings and vehicles. Scope 2 or “indirect” emissions are caused by electricity, steam, cooling and heating purchased by a company. Both of these are relatively easy to track and calculate, as they are part of regular business operations—companies know what materials and energy goes into creating their products and services, how their buildings are used and maintained, and where and how far their company vehicles go.

Scope 3 emissions are more broadly defined. Emissions in this scope are produced in a company’s value chain, by entities that the company does not own or control. These include emissions created by a company’s vendors, consumer product use, portfolio investments, business travel, employee commuting, and more. This means companies will have to gather and manage much more data, from a number of outside sources, than with Scopes 1 and 2.

These new regulations mean that companies not only have to track more emissions—they have to update their processes. Many companies tracking Scopes 1 and 2 have done so using manual reporting and spreadsheets. But this methodology will quickly become unwieldy when taking Scope 3 emissions into account. This added level of compliance also means that companies must make sure reporting and calculations are accurate, which will be exponentially more difficult as more data enters the equation.

WHAT COMPANIES CAN DO NOW TO BE PREPARED, COMPLIANT, AND TRACK CARBON EMISSIONS

Complying with these new regulations means that companies will have greater visibility and control than ever in their sustainability practices. Emissions reporting will give companies extensive and valuable insight into what areas of their business are the most carbon intensive, and how they can be reduced. With more information to act upon, and a responsibility to disclose this information to the public, companies will be able to make their operations across the supply chain as carbon neutral as possible.

One of the first steps executives can take is investing more resources into their sustainability team with these new regulations expected to cost corporations billions of dollars to implement. However, these only account for the initial costs to onboard new reporting methods and are expected to go down year after year. These investments will also result in actionable data that can be leveraged to reduce costs throughout the value chain. (And these costs are preventative—by acting on ESG measures now and reducing carbon emissions, we can avoid trillions of dollars in costs and save millions of lost jobs due to the effects of a rapidly heating planet.)

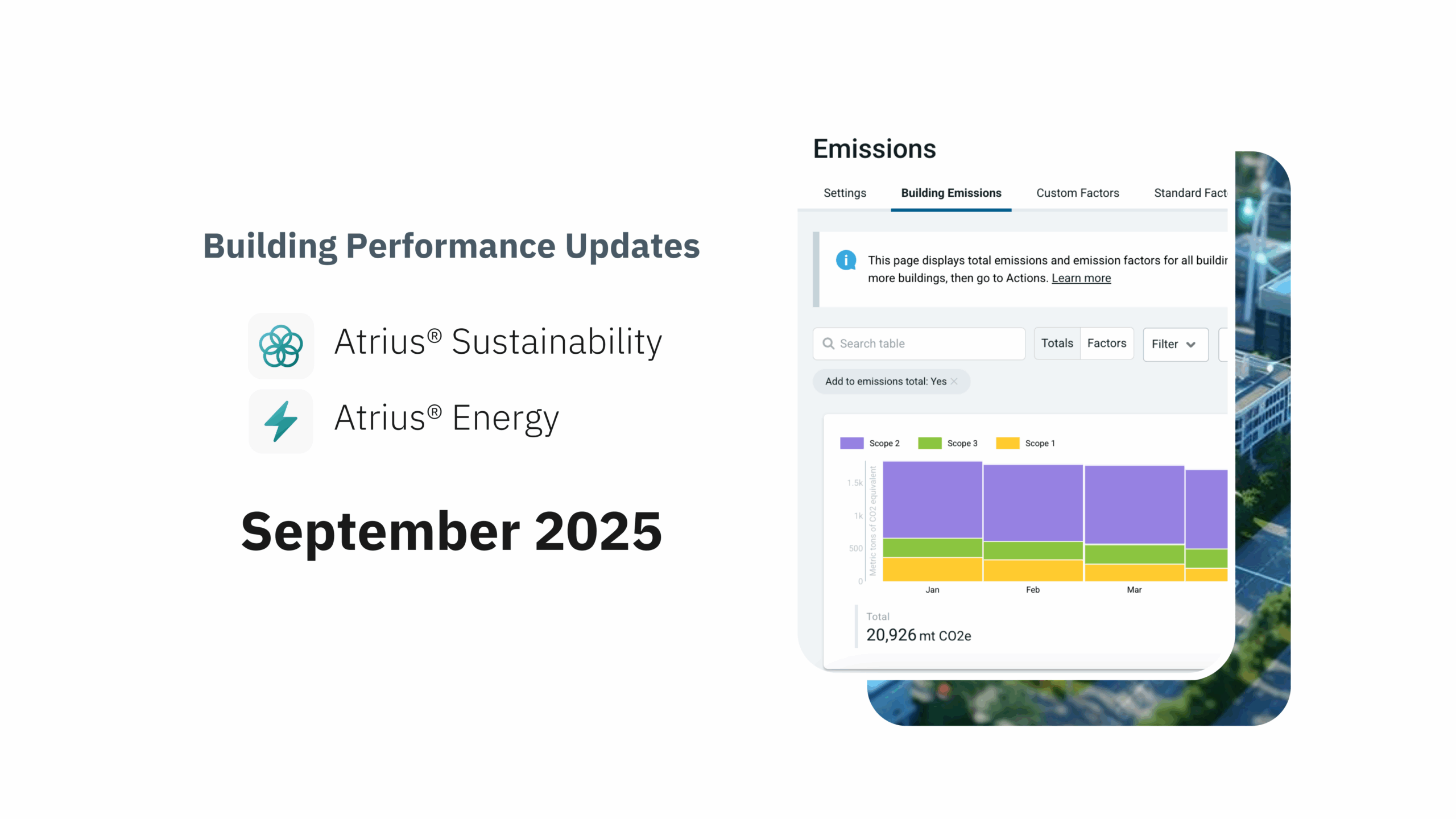

Moving from manual tracking to a cloud-based sustainability reporting platform can make tracking Scopes 1, 2, and 3 emissions easy and manageable. Once a luxury for forward-thinking, green-minded companies, these platforms are capable of accurately compiling all the data needed to be compliant with emissions reporting.

They also provide automated capabilities that reduce labor cost by eliminating manual data management and calculations. With a carbon accounting system, sustainability teams can easily and more quickly review data and make recommendations for reducing emissions, such as partnering with greener vendors, deploying more sustainable solutions at corporate offices and campuses, investing in carbon offset funds, and more.

A FUTURE WITHOUT GREENWASHING

Once these changes go into effect next year, organizations will face an increased responsibility in the fight against climate change. With the valuable insights that the new SEC guidelines will provide, companies will be able to accelerate their sustainability commitments and be a major contributor to reduced emissions. Whether they are just starting on their sustainability journey, or already on the path to net-zero, executives now have a unique and encompassing opportunity to improve their operations and create a brighter future for the world.

Andrew Blauvelt is the Senior Product Director of Atrius, Acuity Brands. He works with building owners, operators, consultants and systems integrator to help provide an integration IoT platform which aggregates, normalizes and benchmarks all building related data to help achieve sustainability goals.

Chelsea Davis is the Product Manager for Atrius, Acuity Brands. Motivated by a passion for the intersection of global sustainability, data and technology, she works on solutions for sustainable buildings, streamlined operations, and personal experiences.